How Much Does Carbon Credit Cost?

Carbon Credit Cost

The value of a carbon credit can be difficult to pin down, as it varies depending on the type and quality of the project, along with how much of the emissions reduction is verified. That said, carbon credits have a significant impact on the environment, and their worth should not be underestimated. However, the price of carbon credit is highly dependent on the market and will be affected by supply and demand, especially as more companies commit to reducing their emissions to net zero.

Carbon markets were devised as a way to encourage companies to reduce their greenhouse gas emissions by creating a system where companies get a set number of credits each year, and can trade those credits on the market if they need more than their allotted amount to offset their emissions. The underlying principle is that a company should be compensated for the additional cost of its operations, since it is responsible for the emissions that are created as a result of its business model.

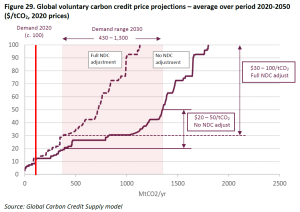

While some companies can achieve the necessary emission reductions through internal policies, many are choosing to purchase carbon.credit as a way to meet their net zero emissions goals. This is known as carbon offsetting, and it is expected to surge over the next decade as more companies set their targets. Carbon credit prices are slated to skyrocket over this timeframe, with the price of offsetting estimated to be between $20 and $50 per metric ton by 2030.

How Much Does Carbon Credit Cost?

The current voluntary market for carbon credit trading is a relatively complex and inefficient process that takes place over the counter, and is dominated by middlemen such as brokers, who will sell to an end buyer for a commission. As a result, the average price for carbon credits in the market is higher than it needs to be.

This is mainly due to the fact that the market for carbon credits consists of a large variety of projects, each with their own unique attributes. As a result, matching a buyer with the right seller is a complicated, time-consuming process that must be conducted over the counter. Furthermore, the prices of certain types of carbon credits have increased significantly over the past year as supply has tightened. This includes credits from forestry, waste disposal, and clean cookstoves.

While the price of carbon credit is a reflection of the market, it is important to note that the actual price of an individual metric ton of CO2 has been determined by scientists. The science-based social cost of carbon, or SCC, has been calculated to be a staggering $3000 per metric ton if climate-economy feedbacks and temperature variabilities are taken into account.

Regardless of the volatility in the market, it is clear that carbon pricing is on an upward trajectory and is a vital component of achieving the climate change goals of the Paris Agreement. Gold Standard continues to advocate for prices of carbon credits that more closely reflect the true social cost of carbon, while still leveraging the power of the market and bringing the benefits of a lower-carbon economy to as many people as possible.